EOG Resources Maximizing

Net Present Value (NPV)

of the Eagle Ford

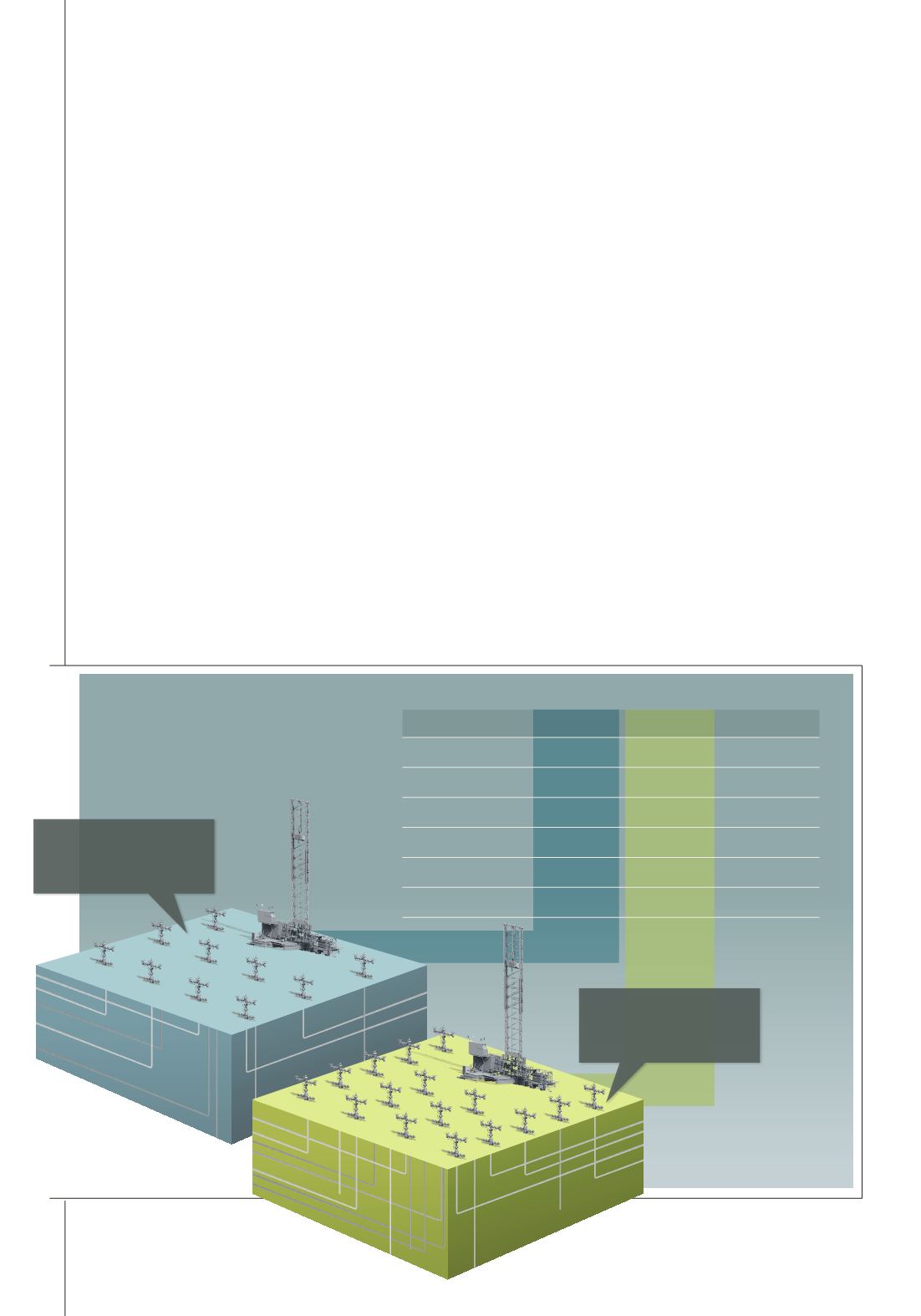

WELLS PER SECTION 10 WELLS 16 WELLS DIFFERENCE

Reserves/Well 450 MMBoe 400 MMBoe

Reserves/640 Acres 4.5 MMBoe 6.4 MMBoe

+1.9 MMBoe

Recovery Factor

= 6%

= 8%

+ 2% Recovery

CWC/Well

$6 MM $6 MM

Direct ATOR/Well

130%

100%

NPV10/640 Acres $69 MM $98 MM

+$29 MM NVP

Source: EOG Resources / March 2013 Investor Presentation

PREVIOUS 640 ACRES

10 WELLS PER SECTION

(65 AC./WELL)

CURRENT 640 ACRES

16 WELLS PER SECTION

(40 AC./WELL)

personnel safety and pipeline integrity, which can

be particularly troublesome given the high paraffin

content of Eagle Ford crude.

But even despite today’s lower oil prices, Zellou

sees new opportunity emerging in the Eagle Ford.

That’s especially so, he says, because current drilling

economics favor wet gas.

As he explains, in the past, on an energy content

basis, natural gas and crude oil were priced at parity.

“Now, even with the drop in crude oil prices

to around US$50 per barrel and natural gas at

around US$3 per million BTU, natural gas is

priced at about half of crude oil on an energy

content basis,” he says. In other words, for the

equivalent amount of energy, natural gas priced

at US$3 per MMBTU is equal to about US$17

to US$20 per barrel of oil. Granted, that’s

considerably less than the US$50 or so that oil

was trading at in January, but the gap is certainly

smaller than when oil was US$100 per barrel.

What this means, Zellou says, is that there’s

product and cash flow in the Eagle Ford.

Still, Eagle Ford operators admit that because

the region is highly variable, with wells in the same

field performing differently, it can be difficult to

generalize break-even costs. And no one seems

comfortable betting on how low oil prices would

have to fall before production starts to level off, or

even decline.

Condensates on the Move: Incentives

for Removing Wet Gas Liquids

Abdel Zellou, Ph.D., a U.S. midstream and

gathering market expert with global pipeline

services provider T.D. Williamson (TDW), has

spent considerable time over the past several years

examining productivity nuances in the Eagle Ford

region. As such, he understands the pressures that

operators there are dealing with. Chief among

them, he feels, are low recovery and high decline

rates compared to conventional wells and the need

to control operating expenses, while still assuring

18