I N N O V AT I O N S • V O L . V I I , N O. 2 • 2 0 1 5

17

“By offsetting the

natural declines

through the use

of new recovery

techniques, further

production increases

are possible. . . "

The Eagle Ford has moved

from being capital intensive

and price-driven to technology

intensive and innovation-driven.

C O V E R S T O R Y

oil equivalent in 2015.

Adding to the Eagle Ford’s accolades is the

fact that the area produces the bulk of America’s

condensate, which grew from 178 million barrels

in 2009 to 274 million barrels just three years

later. And with minimally processed condensate

given the nod for export by the U.S. Commerce

Department’s Bureau of Industry and Security

(BIS), the sky seems to be the limit. But then, the

price of crude oil falls. Again and again and again.

Yes, the drop has caused a stutter in the Eagle

Ford rig count. However, the consensus among

international analysts is that not only can the Eagle

Ford weather a prolonged period of lower prices, it

can prosper.

For example, in December, when oil was

trading in the US$60s, global energy researcher

Wood Mackenzie said production would remain

profitable even if prices dropped to around US$49

per barrel.

Analysts at ITG Investment Research Inc. were

even more optimistic, saying that in some areas

of the Bakken, Permian and Eagle Ford, explorers

can drill new wells profitably, even if crude falls to

US$25 a barrel.

So far, the production numbers justify such

rosy outlooks. Oil output across the United States

has continued to rise despite the national rig count

sagging. During the first full week of January, the

EIA reported, production rose by an additional

60,000 barrels per day.

“These increases have occurred despite the

(Eagle Ford) region’s relatively high well decline

rates,” an EIA briefing said. “However, by

offsetting the natural declines through the use

of new recovery techniques, further production

increases are possible.”

As the EIA suggests, the Eagle Ford has moved

from being capital intensive and price-driven to

technology intensive and innovation-driven. As

such, operators have been able to squeeze more

product from those intransigent formations,

and save money in the process. Among the

improvements, better completion techniques

have boosted initial production rates. Tighter

well spacing has helped maximize production

and increase reserves, and altering variables like

the frac fluid and proppant is further building

output. Integrated electrical and control systems

have decreased energy consumption, while

computerized monitoring oversees key process

data, including flow rates, pressures, and leak

detection – really, anything that could stop or slow

production. In short, automation is helping both

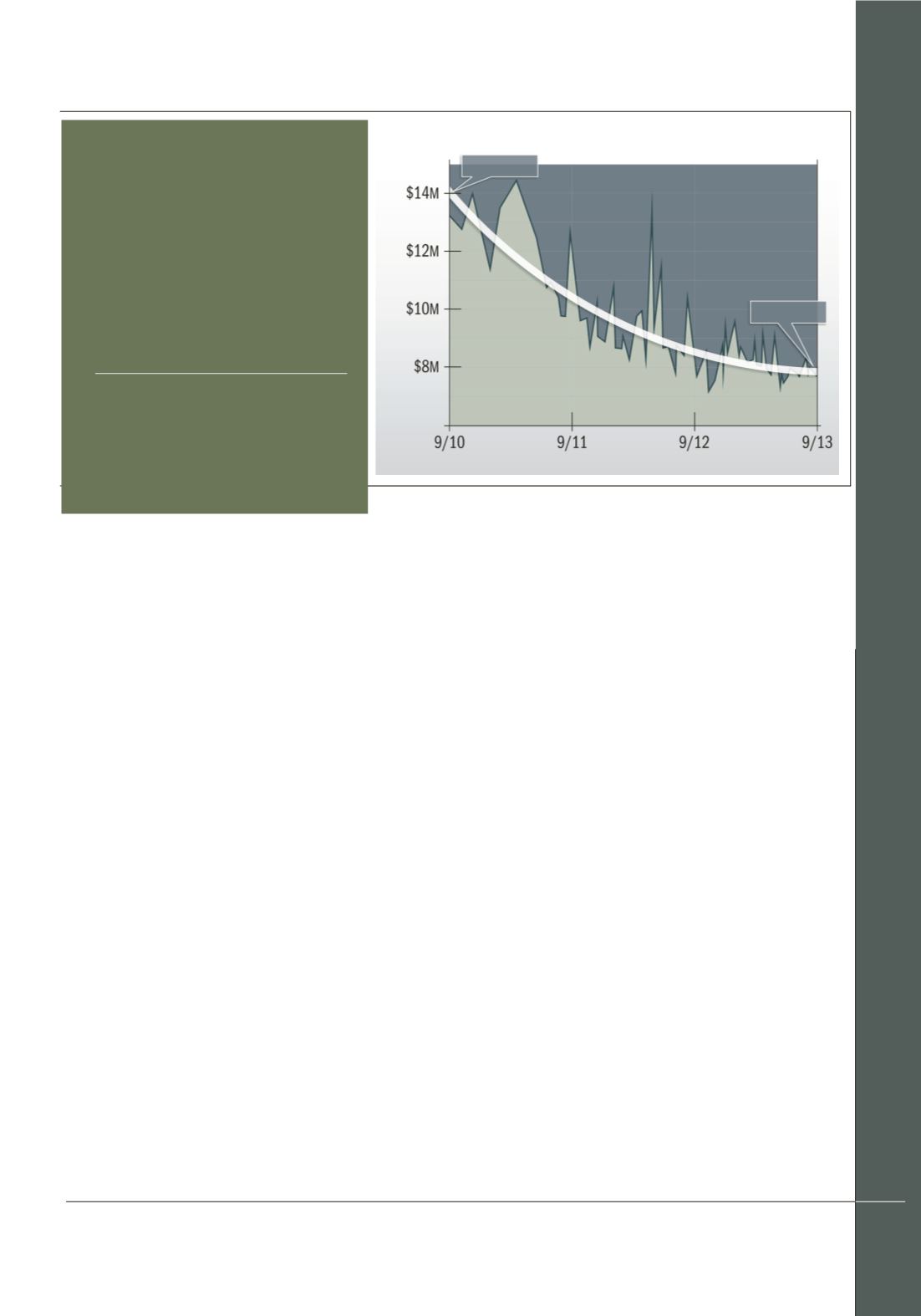

Sept. 2013

Source: Energy InformationAdministration

Sept. 2010

PROJECT START DATE

Eagle Ford Well Costs

WELL COST